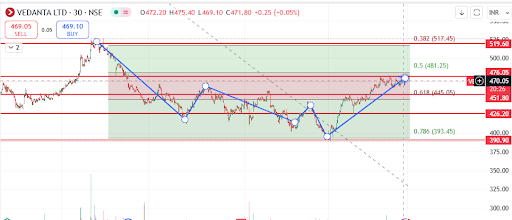

The chart provided is a 30-minute chart of Vedanta Ltd (NSE), featuring Fibonacci retracement levels, support & resistance zones, and price action analysis. Let's break it down:

1. Key Levels Identified

-

Resistance Levels:

-

481.25 (0.5 Fibonacci level)

-

517.45 (0.382 Fibonacci level)

-

519.60 (Major resistance zone from the past trend)

-

-

Support Levels:

-

445.05 (0.618 Fibonacci level - important retracement support)

-

426.20 (Strong price action-based support)

-

393.45 (0.786 Fibonacci level - deep retracement zone)

-

2. Trade Strategy

Bullish Trade Setup (Buy Side)

-

Entry: If the price breaks and sustains above 476-481.25

-

Target 1: 517-519 (major resistance)

-

Stop Loss: Below 445 (0.618 retracement level)

-

Reason: The price has formed a double-bottom-like structure and is currently retesting resistance at Fibonacci 0.5 level (481.25). A breakout could push it higher.

Bearish Trade Setup (Sell Side)

-

Entry: If the price fails to break 481-485 and starts rejecting downward

-

Target 1: 445 (0.618 Fib level)

-

Target 2: 426 (strong support level)

-

Stop Loss: Above 485

-

Reason: If the price gets rejected at 481.25, it may indicate weakness and a potential downward move towards the 0.618 level (445.05).

3. Trend Analysis

-

Short-Term Trend: Bullish (Higher highs and higher lows forming)

-

Long-Term Trend: Still needs confirmation; breaking 481-485 will confirm bullish continuation

4. Final Decision – Which Side to Trade?

-

If price breaks above 481 and sustains → Buy for a target of 517

-

If price rejects 481 and falls below 470 → Sell for a target of 445

Conclusion

-

Watch for breakout or rejection at 481.25 to decide the trade direction.

-

Risk-Reward Ratio: Ensure at least 1:2 risk-reward before entering the trade.

Vedanta Ltd (NSE) – Technical Analysis & Trend View

The stock is currently at ₹471.80 and is approaching a key Fibonacci resistance level at 481.25. Below is the breakdown of the short-term, medium-term, and long-term trends with technical analysis.

1. Trend Analysis & View

🔹 Short-Term Trend (Intraday to 1 Week) – Bullish with Resistance Ahead

-

Current Price Action: The stock has been making higher highs and higher lows, indicating a bullish trend.

-

Resistance Zone: 481.25 (0.5 Fibonacci level)

-

Support Zone: 445.05 (0.618 Fibonacci level)

-

Trade View:

-

If price breaks above 481 and sustains, expect a rally towards 500-519.

-

If rejected at 481, price could pull back towards 445.

-

✅ Short-Term Bias: Bullish, but resistance at 481.25 is critical.

🔹 Medium-Term Trend (Few Weeks to Few Months) – Bullish but Needs Confirmation

-

Uptrend Confirmation: A closing above 481 will confirm a medium-term uptrend.

-

Target: If price sustains above 481, it could reach 517-520.

-

Support: 445 & 426 are crucial support levels to watch.

-

Risk: If price fails to hold above 445, then selling pressure could drag it to 426-400 levels.

✅ Medium-Term Bias: Cautiously Bullish; needs a breakout above 481 for further upside.

🔹 Long-Term Trend (6 Months to 1 Year) – Consolidation with Possible Upside

-

Major Resistance: 519-520 is a strong resistance. Breaking this level could push the stock towards 550-580 in the long run.

-

Support for Long-Term Investors: 390-400 is a strong long-term demand zone.

-

Bearish Risk: If price falls below 390, then long-term bearishness will be confirmed.

✅ Long-Term Bias: Neutral to Bullish. Needs a breakout above 520 for a strong uptrend.

2. Technical Indicators & Patterns

-

📉 Fibonacci Levels: Price is near the 0.5 retracement (481.25), which is a critical level for trend direction.

-

📊 RSI (Relative Strength Index): If RSI is above 60, it indicates strong momentum. If RSI starts declining near 481, a reversal is possible.

-

📈 Moving Averages:

-

50 EMA (short-term) → Price is above it, bullish.

-

200 EMA (long-term) → If price stays above it, bullish confirmation.

-

-

📊 Price Pattern: Forming a W-bottom or inverse head & shoulders, which is bullish if it breaks 481.

3. Trading Strategy

Bullish Trade (If 481 Breaks)

📌 Entry: Above 481

🎯 Target: 500-519

❌ Stop Loss: Below 470

Bearish Trade (If Price Fails at 481)

📌 Entry: Below 470

🎯 Target: 445-426

❌ Stop Loss: Above 485

Final Verdict: What to Do?

✅ Short-Term → Bullish, but watch for a breakout above 481.

✅ Medium-Term → Bullish if 481 holds, cautious if rejected.

✅ Long-Term → Neutral to Bullish, but 520 breakout is needed for strong upside.

💡 Suggestion: Watch price action near 481-485 for direction. If it breaks, go long; if rejected, short-term selling pressure could emerge.

No comments:

Post a Comment