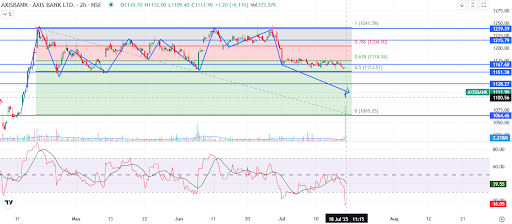

Axis Bank Ltd. (NSE) based on the provided chart and technical indicators.

- Technical View Current Price: ₹1111.90

Trend:

The stock is in a short-term downtrend, moving lower from the ₹1170-1200 zone.

The price is now hovering near a crucial support area.

Fibonacci Levels:

0.618 Retracement: ₹1174 (earlier strong support, now resistance)

0.5 Retracement: ₹1153 (acting as resistance now)

0.0 Level: ₹1065 (major downside target)

Relative Strength Index (RSI):

RSI is near 16, which indicates oversold conditions.

A short-term technical bounce is possible if support holds.

- Key Support & Resistance Immediate Resistance:

₹1115 – minor hurdle

₹1153 – Fibonacci 50%

₹1167–1174 – strong resistance

Immediate Support:

₹1100 – psychological level

₹1080–1065 – major support zone

If the stock breaks ₹1100, it can test ₹1080 → ₹1065. If it sustains above ₹1128, a short-covering rally towards ₹1153-1167 is possible.

- Pivot Levels (2H chart) Pivot Point: ~₹1128

Support 1: ₹1115

Support 2: ₹1100

Support 3: ₹1065

Resistance 1: ₹1153

Resistance 2: ₹1167

Resistance 3: ₹1174

- Trade Setup ✅ If bullish (for bounce):

Buy near ₹1100–1110 with target ₹1128 → ₹1153 → ₹1167

Stop Loss: below ₹1090

✅ If bearish (trend continuation):

Sell if price breaks ₹1100 decisively

Target: ₹1080 → ₹1065

Stop Loss: ₹1128

- Fundamental View Axis Bank is one of the leading private sector banks with strong fundamentals:

Stable NIMs (Net Interest Margins) around 4%

Improving asset quality – GNPA below 2%

ROE ~18%, showing healthy profitability

Well-positioned for credit growth with a diversified loan book

Macro Factors:

RBI policy, interest rate changes, and liquidity conditions will impact the stock.

Private banks have been under pressure due to profit booking after a strong rally.

From a long-term view, Axis Bank remains fundamentally strong, so dips near ₹1065-1080 could be good accumulation zones for investors.

Summary Short-term: Weak trend, may test ₹1100 → ₹1080

Medium-term: Watch for a bounce if RSI recovers from oversold zone

Long-term: Fundamentally strong; buy on dips near ₹1065–1080

No comments:

Post a Comment